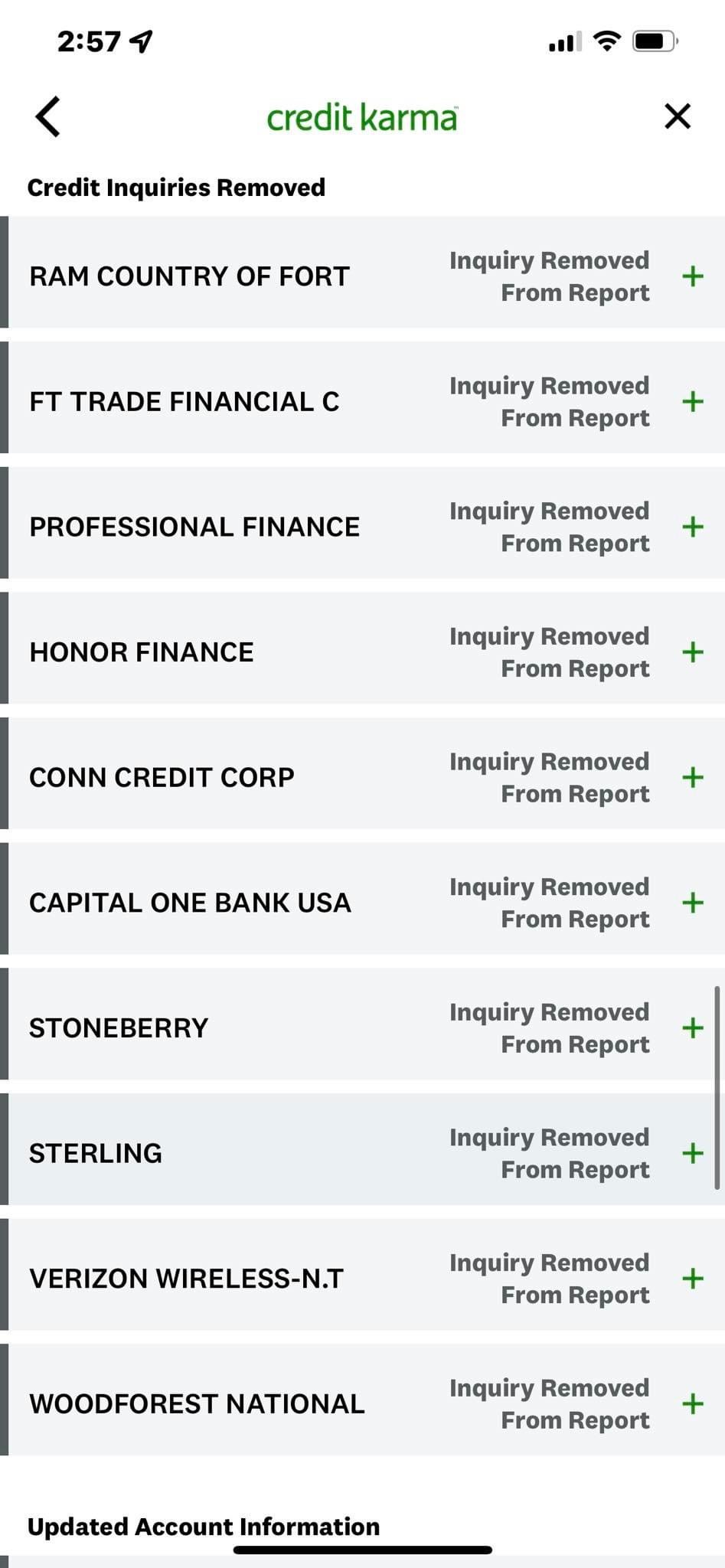

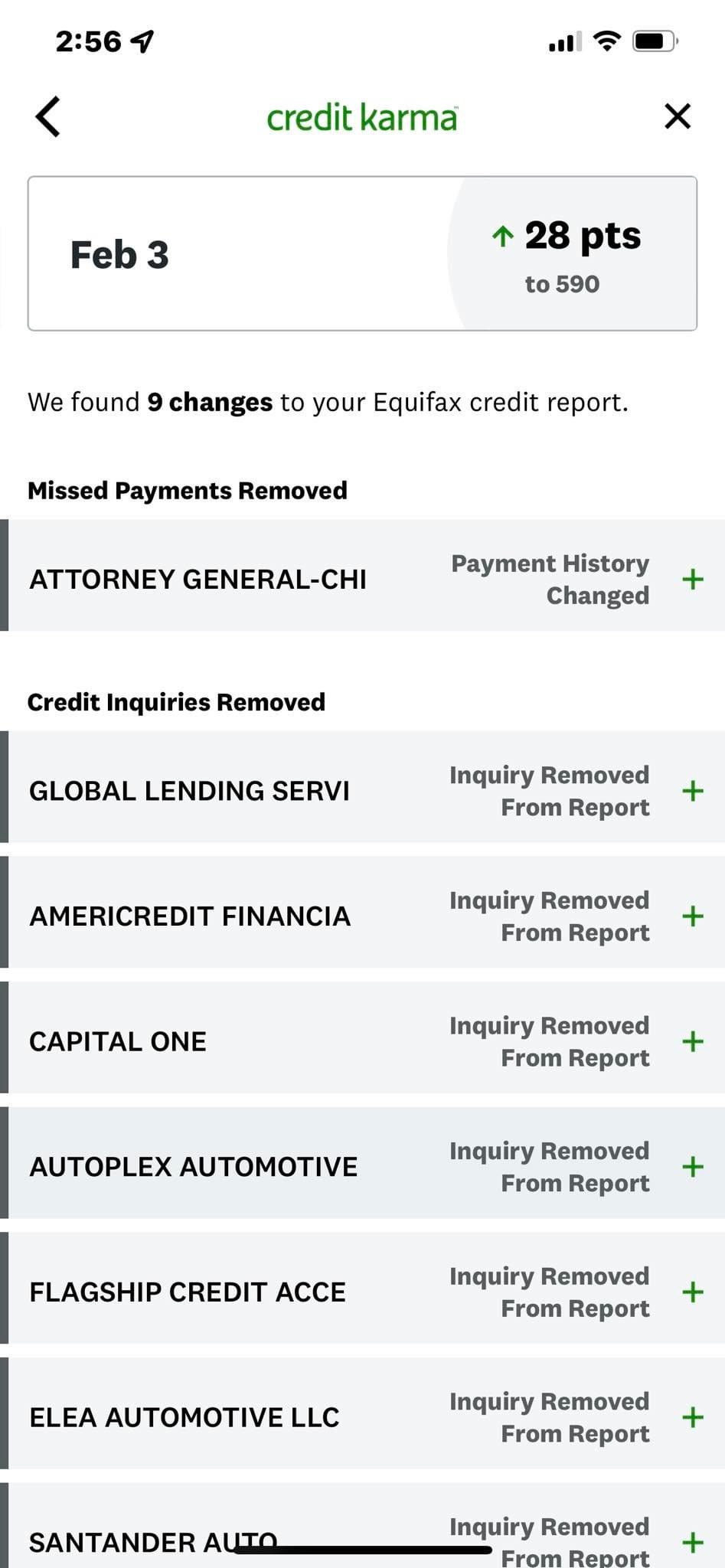

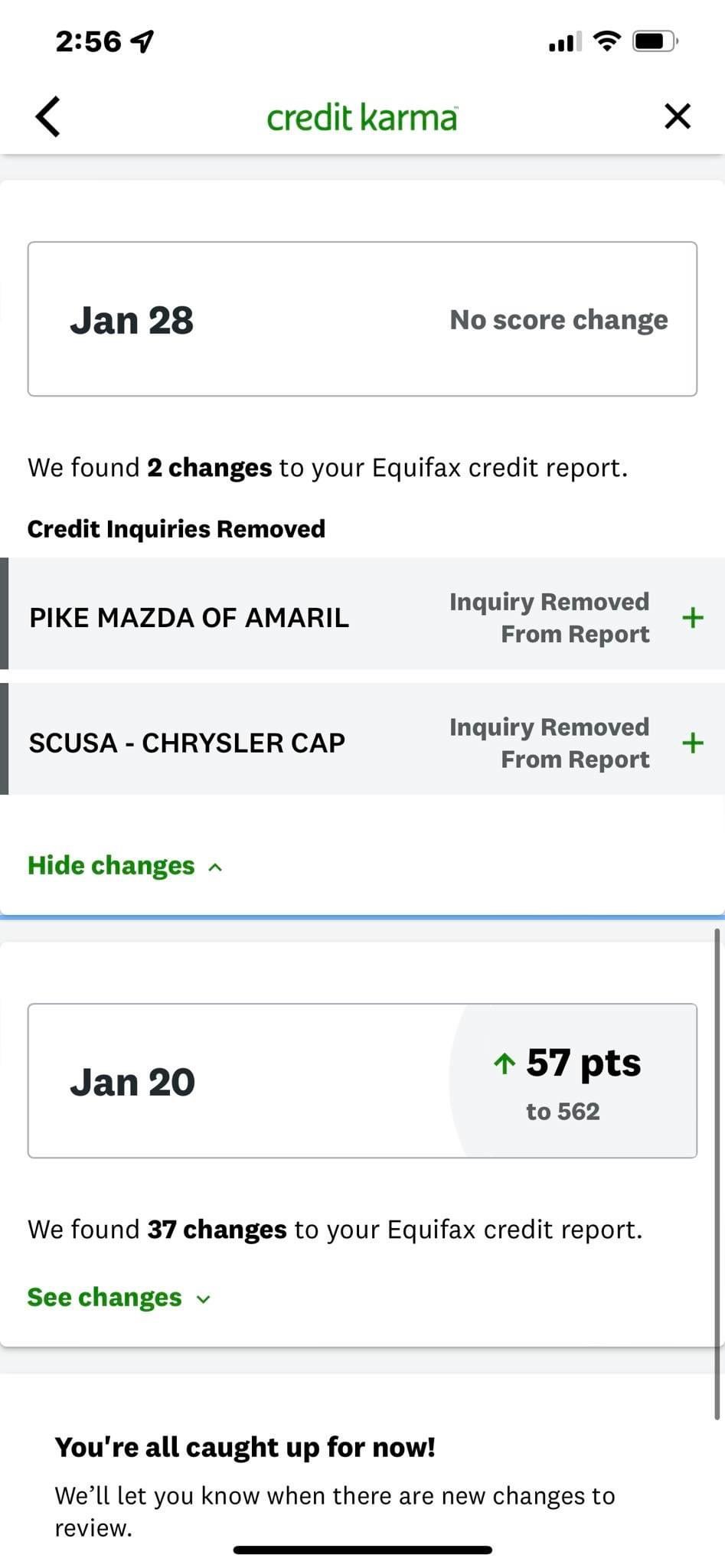

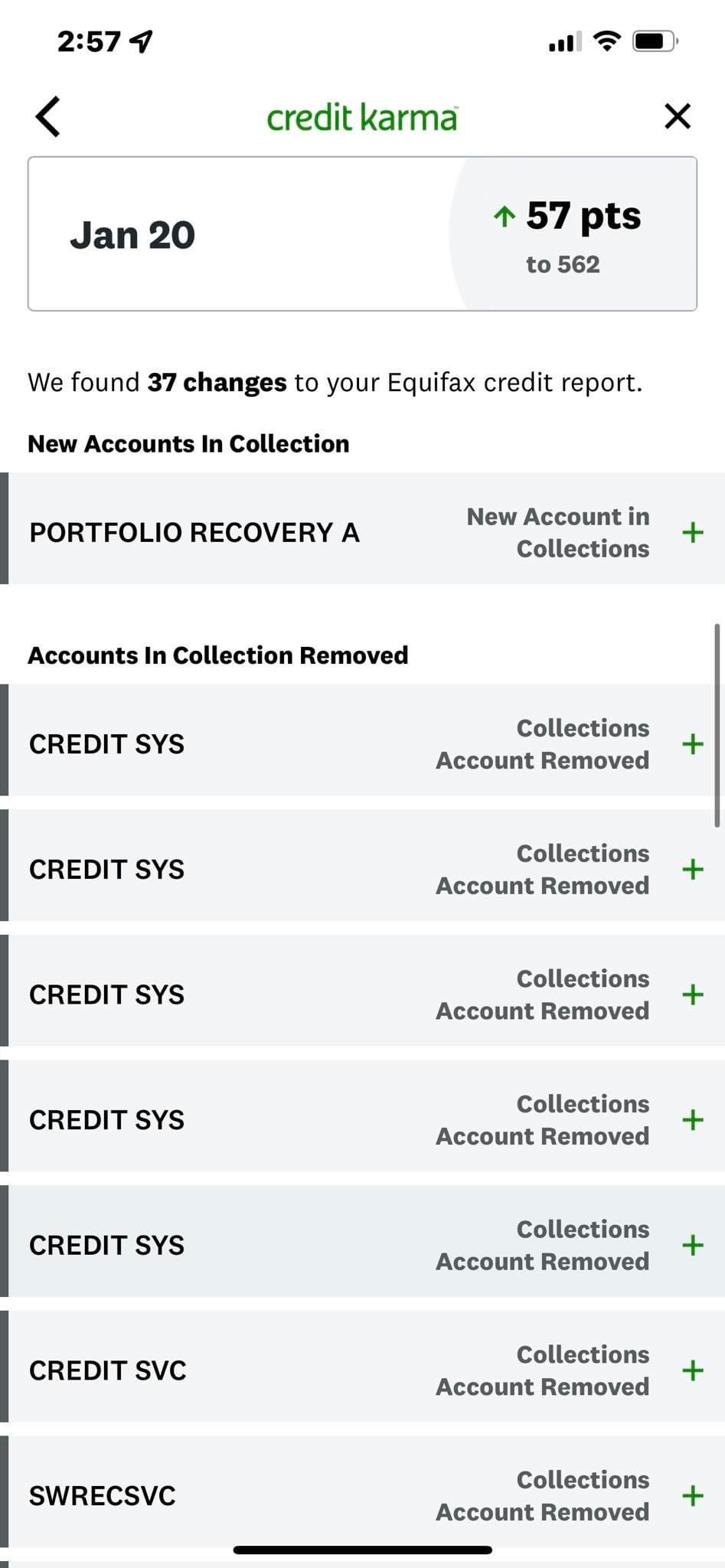

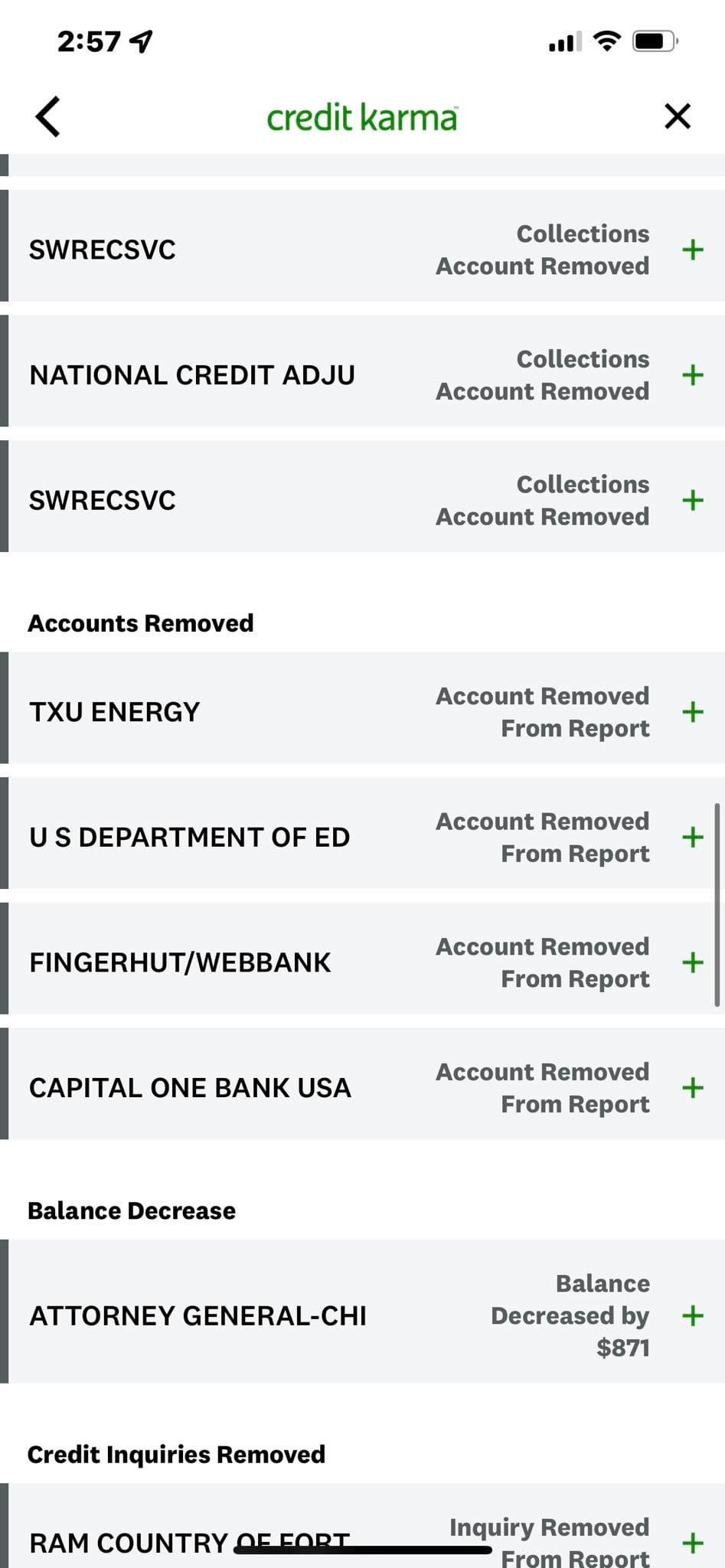

I raised my score 112 points in 3 months thanks to Credit Enterprise!

Fix Your Credit

Build Your

Future

Whether you need professional credit repair, a custom consultation, or just the right tools to do it yourself — Credit Enterprise gives you everything you need to take control of your financial journey.

HOW IT WORKS

Simple, Proven, Effective

Audit & Plan

We analyze your credit report and create a custom action plan.

Dispute & Build

We dispute inaccurate items and guide you to add positive credit.

Grow & Maintain

Whether you work with us or go the DIY route, we help you stay on track and move toward

your goals.

WHO

WE HELP

- First-time credit users

- People with collections, charge-offs, or late payments

- Entrepreneurs needing to build business credit

- Anyone looking to qualify for loans, homes, or better rates

Why Choose Credit Enterprise?

Proven Results

Clients see an average increase of 80–150 points within the first 3–6 months

Transparent Communication

Real-time updates, monthly progress reports,

and a personal credit advisor

Secure & Confidential

Your information is safe with us—always.

Personalized Plans

One-size-fits-all doesn’t work for credit. We tailor everyplan to your unique needs

TESTIMONIAL

PREVIEW

These guys are the real deal! They removed multiple collections from my credit report and helped me understand how to keep my credit healthy. I feel in control of my finances again.

Kate A., Jacksonville, FL

From the first consultation to the final results, the team was honest, responsive, and truly committed to helping me. My score jumped from 540 to 710!

Josh F., NJ

I had no idea what was on my credit report. Credit Enterprise found 12 errors and helped me remove all of them. I can finally breathe again.

Jack L., Atlanta, GA

Our

Gallery

Our

Videos

Frequently

Asked Questions

What is credit repair?

Credit repair is the process of identifying and disputing inaccurate, outdated, or unverifiable information on your credit reports. We work directly with credit bureaus and creditors to remove errors that may be negatively affecting your score

How long does the credit repair process take?

It depends on your specific situation, but most clients begin seeing results within 30 to 60 days, with full improvement typically occurring over 3 to 6 months. We provide monthly updates so you can track your progress every step of the way

Can you guarantee results?

While we can’t legally guarantee specific outcomes (and no honest credit repair company will), we guarantee honest service, aggressive disputes, and professional guidance. Many of our clients see significant score increases and removals of negative items

What kind of negative items can be removed?

We help remove or correct:

• Late payments

• Charge-offs

• Collections

• Bankruptcies

• Inquiries

• Identity theft-related errors

Will paying off my debt fix my credit score?

Not always. While paying off debt can help, it doesn’t automatically remove negative marks from your credit history. That’s where credit repair comes in—to help clean up inaccurate or harmful entries

Is credit repair legal?

Yes, absolutely. Under the Fair Credit Reporting Act (FCRA), you have the legal right to dispute any inaccurate or unverifiable information on your credit reports. We simply act on your behalf to make the process faster and more effective.

How much does your service cost?

We offer affordable monthly plans and custom pricing depending on the level of service you need. We also provide free consultations to assess your credit and discuss your goals before you commit to anything.

Will working with you hurt my credit?

No. Disputing inaccurate items with the credit bureaus is a safe and legal process and will not harm your credit score—in fact, the goal is to improve it.

Do you offer credit counseling too?

Yes! We don’t just fix credit—we help you understand it. Our team provides personalized coaching on budgeting, debt management, and smart credit usage to ensure long-term results.

How do I get started?

It’s easy! Click the “Free Consultation” button, call us at 8482469799, or send us a

message. We’ll evaluate your credit report and create a plan that fits your needs.

Ready to Take

Control of

Your Credit?

Don’t let bad credit hold you back. The path to financial freedom starts here

Schedule a Free Consultation today and let’s start repairing your credit—together.

- protechcleaning4you@gmail.com

- tunnelvizzion

- Mon–Fri: 9am–6pm